Consumer Retail in India: Premiumisation and Predictions

How premiumisation manifests differently for the India 1 and India 2.1 consumer

Ah October.

Winter blankets North India with a cloud of smog. Bangalore chugs along (or not, because traffic (except the lone leopard who managed to find the fastest way from Kudlu to Whitefield)).

Across the country it is also post harvest, festival, and wedding season, a trifecta which combines to get the Indian consumer to loosen her purse strings. Retail consumption peaks, and everyone from traditional retailers to new age e-commerce companies sets up enticing sales to get a share of the consumers wallet.

It’s also a great time for people like me - who are trying to piece together a narrative on the Indian consumer story - because there’s suddenly lots of data!

This post is an attempt to stitch together some data and anecdotes, and make some predictions about commerce in India 1 and India 2.1.

Premiumisation is driving demand

And this seems to be true for both offline and online retail. However, it is interesting to look at this trend from the lens of India 1 consumers and India 2.1 consumers separately.

Let’s start with e-commerce.

Festive sales data tells us that consumers are spending more on premium categories.

Ecommerce is witnessing “very strong premiumisation across categories”, unlike earlier when online stores were seen as platforms for value deals, said Saurabh Srivastava, vice president, Amazon India.

The premiumisation trend is not restricted to e-commerce or to Tier 1 cities

Smaller towns are the new frontiers for premium products. Titan says:

"The contribution of top 10 cities has declined 4-5% and gone in favour of Tier 3, 4 cities - that long-term trend is indisputable and every retailer has to pay attention to these markets," Ashok Sonthalia, chief financial officer of Tata Group-backed Titan Company, has told ET. Titan sells watches under the Titan and Fastrack labels besides jewellery brands Tanishq, CaratLane and Mia, along with Skinn perfumes and Taneira sarees.

Everyone has seen the large Soch store in the Forum mall in Koramangala? It sells premium (maybe even designer?) apparel for women, and every time I saw the store I’d mark it down as a place where I’d never buy anything because it’d be too expensive (call it middle class conditioning).

Where do you think Soch is opening their next few stores?

"Soch, another ethnic wear brand, has opened stores in cities like Kurnool, Muzaffarpur, Gorakhpur and Jaipur. It plans to start outlets in Udupi, Dehradun, Allahabad, Madurai, Ludhiana, Barnala, Faridabad, Jodhpur, Vellore and Thrissur, ET has reported"

And where are big mall developers spending their money?

Atul Ruia, chairman, Phoenix Mills, India’s largest mall chain, can’t stop talking about this to his investors. His Phoenix Palassio mall at Lucknow, Uttar Pradesh has surpassed trading density of INR10,000 per sq feet in less than two years. His malls in metros such as Mumbai and Bengaluru took anywhere between three and six years to achieve this feat.

Aspiration drives premiumisation

In a previous post, I had talked about the India 2.1 consumer being extremely aspirational - driven by an increase in disposable income & access to social media (which tells her exactly how to be aspirational).

The India 1 consumer is slightly different.

Aspiration for India 1 manifests in D2C e-commerce

Recall that this person thinks in English, and has definitely watched Friends. Just like she has abandoned ‘massy’ Facebook for Instagram, she is also on the brink of abandoning horizontal e-commerce for vertical D2C, starting with aspirational categories (beauty & apparel).

You can put this down to consumer evolution - 10 years ago when e-commerce hit India 1 consumers, they were paying for convenience and selection. Now that they have more money to spend, they are moving their premium purchases to D2C brands, which are better placed to solve their problems of selection, convenience, and more importantly, status.

Premium consumer spend for India 1 in established categories is moving from Amazon, Flipkart and Myntra to more niche brands with their own websites. (checkout Mainstreet - premium sneaker marketplace).

Instagram is the melting pot for these brands, with its unique combination of personalisation, heavily visual feed, and influencers. Women I know now discover cool stuff to buy (emphasis added) almost exclusively on Instagram - all the way from ceramics & jewellery to sustainable toiletries - and all at the very top of the premium range.

Anecdote: My wife has a clear split in her shopping behaviour now. For purchases where she knows what she wants to buy, she prefers Amazon or Myntra, but all her aspirational shopping journeys start on Instagram. The Meta owned platform with its deep personalisation and friends network has become the perfect place for product discovery. We’ve purchased artisanal ceramic cutlery, silver jewellery, and silk clothing - all from shops found on Instagram.

Aspiration for India 2.1 manifests in modern retail and horizontal e-commerce

On the other end of the spectrum, the India 2.1 consumer has just started to build trust on digital commerce and payments. This shift in has been helped by the big players bombarding mass media with content aimed at building trust (Flipkart/Amazon in e-commerce, and Paytm/PhonePe in payments).

Aspiration for this audience manifests in the need (or ‘want’ to use language from marketing 101) for products which are not immediately available in their vicinity.

This leads to increased demand for two services:

Horizontal e-commerce which solves for a wide selection

Modern retail (supermarkets, malls) which solve for aspirational shopping experiences, complete with air conditioning, clean surroundings, and as an alternative for public spaces.

So here’s my hypothesis.

As trust and aspiration both build in India 2.1, modern retail (offline) will continue to thrive. Online shopping behaviour will grow and mature, primarily driven by horizontal e-commerce players.

Not surprisingly, this is what Amazon thinks as well. From the ET article linked previously.

Amazon attributes this to an increase in disposable incomes, aspirational demand, deeper e-commerce penetration, and demand from Tier 2 and Tier 3 cities.

Modern formats, affordability, & cheaper distribution will speed up the deepening of consumer retail

Modern Retail

As aspirations peak, consumers are going to look for more choice and a better shopping experience. Modern retail is at the forefront of this trend - for this consumer, a shop in your neighbourhood is any day better than waiting a few days for your order. And you have A/Cs, great lighting, maybe even a food court thrown in. Expect supermarkets, malls, and high street shopping experiences to grow fast to meet this demand.

Clearly, consumers today prefer D-Mart over their local kirana.

(Aside: What does this say for the Indian Kirana story? A prompt for another post).

Affordability

Affordability is a key lever in driving consumer buying behaviour. (duh, but it needed to be said).

For example, D-mart catering to the India 2.1 aspiration of shopping in a well lit, air conditioned, selection heavy store is not the only thing it has gotten right. The Indian consumer is famously value conscious, and D-mart has excelled in delivering the right price / value / convenience combination.

Another obvious lever for affordability is consumer credit. Over the past few years we have seen credit expand exponentially fast for the masses. A good example is consumer durable loans - something that has driven purchase behaviour in offline stores. Bajaj Finance is one of the largest players in this space, with a loan book of ~22000 crores for consumer durables (up 20% YoY, page 24, annual report) in FY 23, which is 22% of their net loan book.

For e-commerce the analogue is BNPL (buy now pay later) services (Simpl, Lazy Pay), with the key difference that they operate in low ticket sizes compared to the behemoth that is Bajaj Finance (at least today).

If horizontal e-commerce players are able to combine their selection + convenience play with affordability in India 2.1, there is a big market to be won.

Suddenly Flipkart’s foray into lending does not seem all that off.

Unlocking Cheaper Distribution - Influencer driven e-commerce

Every marketer worth her salt knows that FB and Google are reaching that point where every additional rupee is not adding incremental new reach. For India 1 consumers, the business model with expensive digital ad driven acquisition still works because of higher priced items. But, beyond a point, it doesn’t work for brands wanting to reach beyond the premium audience.

This means organic reach and influencer marketing are the new mantra.

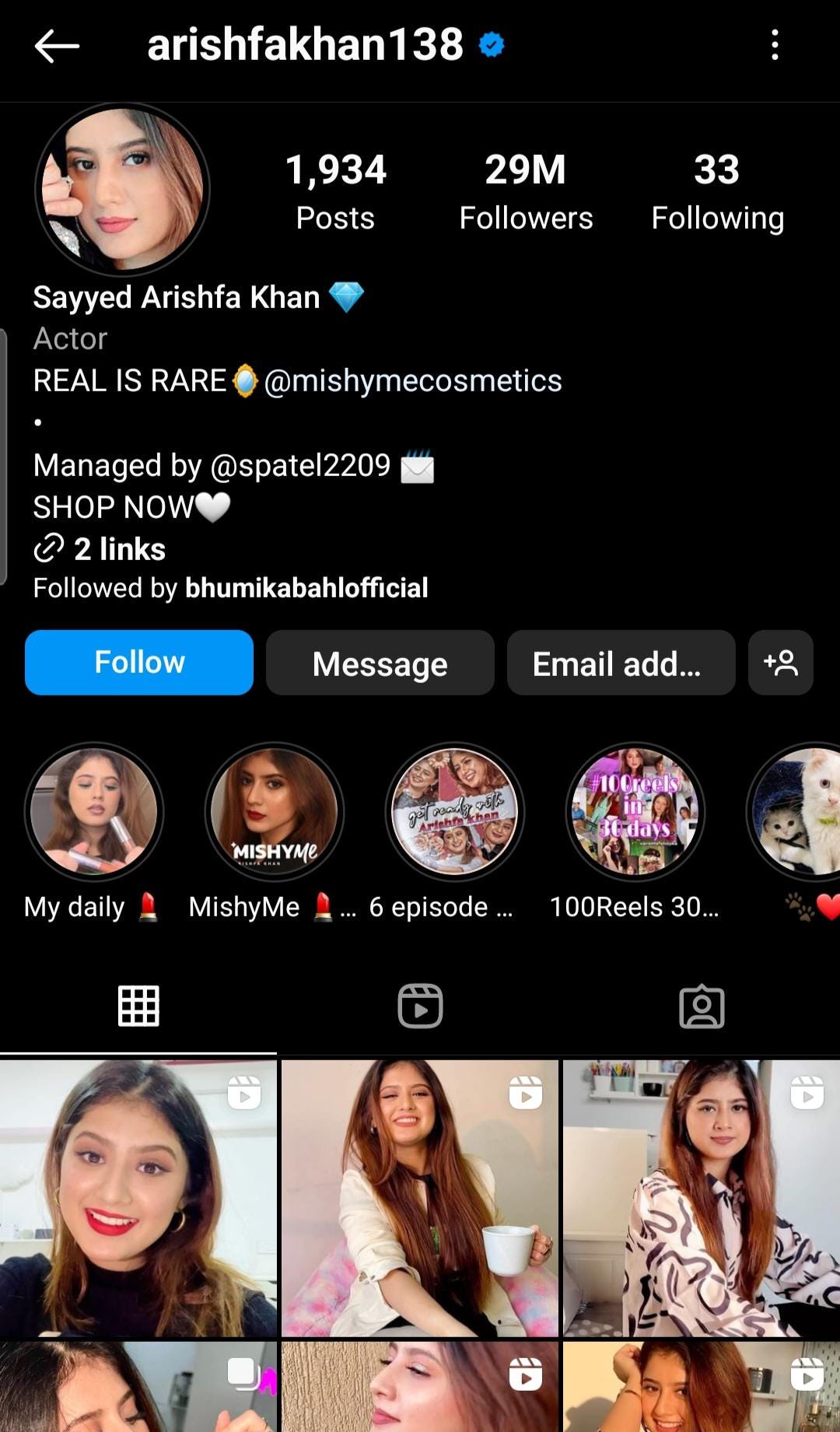

India 2.1’s aspiration is manifested in influencers, especially post Tik Tok. (Remember Mr Faisu and Arishfa Khan, who rose from obscurity courtesy short video?). This new crop of home grown influencers is what every other young person in India 2.1 aspires to be.

And this makes these influencers the perfect vehicle to launch products and brands targeted at this audience.

Who stands to gain?

Creators, obviously. Also legacy agencies like Qyuki & tech enabled platforms like One Impression, which connect brands to new age creators. There are also interesting platform plays like Swirl which enable you to add video and live streams to your website in a few clicks.

Side Note: What about live commerce and shoppable commerce?

There’s tons of expectations around the content x shopping model.

Bytedance’s Duoyin did an eye-popping ~200 billion USD in GMV in China last year. Now, TikTok has big plans for the US market.

From this article

Currently, TikTok spokesperson Laura Perez said more than 200,000 sellers have registered for TikTok Shop. Meanwhile, over 100,000 content creators are participating in the affiliate program, which allows users who have 5,000 followers to create videos that go directly to TikTok’s algorithmically-engineered “For You” feed.

But, this model has not yet taken off in India (live commerce or shoppable commerce). Why?

We can frame a hypothesis if we view the question in context of the India 1 and India 2.1 consumer.

If the India 2.1 consumer is still moving up the value chain and building trust in horizontal e-commerce, then it makes sense that live commerce and shoppable commerce today will have low adoption. For these models, even with the influencer driving selection visibility and demand, India 2.1 consumers are still going to come up against the barrier of buying online.

If we combine this with the penetration of social apps, it is reasonable to assume that large volumes in social and influencer led commerce will be driven by India 2.1, but only after consumers cross the trust barrier via horizontal e-commerce.

PS: I thought Naaptol, the OG of semi-live semi-influencer led commerce, was a narrative violation to this hypothesis, but it turns out they only did 100cr of Revenue in FY 22. So it’s still not a large business.

PPS: A brilliant case study of scaling an aspirational brand through a mix of online and offline for the India 2.1 audience is Atomberg. Arindam Paul, part of the founding team, shares valuable playbooks on X (formerly Twitter).

Looking at the Indian consumer story through the lens of premiumisation throws up very interesting questions, and adds a lot more nuance to the ‘India is a shallow consumer market’ narrative.

As I have maintained, there is a lot of money to be made from the Indian consumer (and no, it is not at ‘the bottom of the pyramid’).

If all consumers (India 1, India 2.1) are ‘premiumising’ their purchase behaviour, then what remains is to figure out how to tap this demand, and couple it with great insight and great execution.

Examples abound - like Bajaj Finance and D-Mart.

And also like this enterprising shop owner who converts Poco (Android) to the latest iPhones in minutes, much to the chagrin of Steve Jobs.

That’s all folks!

I love how The India Pivot covers India’s tech innovations and startups. It’s inspiring to see the country making waves in the global tech scene