How Tech Companies are Monetising India 2

Virtual Gifting, Digital content, Hyperlocal Communities, Devotion, Dating & More

Substack tells me this post is too long for email (oops). So pls click on the link above to read in browser!

In keeping with the times, the focus of this piece will be on monetisation of the India 2 user.

(No, no VCs have asked me to switch from growth to monetisation, this is all from inside my head only).

In Monetising Bharat, I had talked about how platforms with large MAU could monetise at scale with ads. The caveat is that the ads ecosystem in India is still nascent, and it will take a mixture of traditional digital advertisers shifting to new platforms, SMB ad buying shifting to digital, and new products aimed at this audience for this to kick in.

Since then a couple of interesting things have happened.

1/ India’s digital ad market is growing

Meta India gross revenue is up 13% to ~18k crore (~2.2b USD) in FY 23. This includes ad inventory sold on FB, Insta, & Messenger. Also note that there is a lot of headroom for business messaging on WhatsApp to grow revenues, so this number is going up.

“Overall, I see green shoots in terms of the ad market itself growing as the economy continues to grow. And India is one of the fastest ad markets globally. Digital is powering a lot of that growth,” acc to Meta India VP and Head Sandhya Devanathan told ET in an interview.

So a part of the hypothesis from Monetising Bharat on the growth of the digital advertising market seems to be panning out.

2/ ShareChat revenue is up ~60% driven by virtual gifting

Out of Rs 550 cr, ~270 cr is from advertising, and 285 cr is from virtual gifting. Virtual gifting revenue grew 2.3x year on year.

‘ShareChat Coin’, the in-app virtual currency, purchases for its chat rooms overtook its advertisement income to form 52% of the total revenue. This income surged 2.3X to Rs 285 crore in FY23 from Rs 121 crore in FY22

This is another part of the monetisation story for India 2 - there are a potentially large alternate monetisation models that are possible for the India 2 audience. Virtual gifting (or more generally selling digital goods) is just one of them. What are the other interesting models that people are building?

Note: When I say interesting, I’m steering clear of large & obvious sectors like e-commerce, fintech, and real money gaming.

ShareChat: Digital goods for entertainment

Let’s talk about ShareChat and virtual gifting first. ShareChat is India’s largest regional language social media platform. (The parent company of ShareChat also runs Moj, which is a short video platform focused on India 2). The core product is a content feed, run by sophisticated AI in the backend, which delivers personalised content on a ‘For You’ feed.

On top of this retention engine are built multiple other long tail features, one of which is an audio chatroom.

At the very fundamental level, think of audio chatrooms as a Clubhouse equivalent built for a regional language audience. The product allows you to interact with hosts and participants in live audio, you can listen in on conversations, or take part via text. How it differs from Clubhouse though, is the go to market positioning that has allowed it to monetise so well.

Audio chatrooms = Being invited to a Party

I’ve described audio chatrooms as being invited to a party. You enter the party venue and see multiple conversations happening in small groups. As a partygoer you want to go and find the most interesting conversation (room) to join. Each room is led by a host, who has the responsibility of keeping the conversation fun (and the product has multiple in built tools to enable hosts to do this). Like in any conversation, you can choose to actively participate or be a bystander. To participate, you have to bring something of value into the conversation. In audio chatrooms you do that by buying virtual gifts, and sending them to the host and other participants. In turn, hosts induct you into the conversation.

The reaction I generally get when I explain this to people is - ‘Are you serious? People are paying hosts to be part of these chatrooms?’

My answer

Yes.

The fact that this is surprising to so many people should be cause for optimism. What other kind of monetisation models are yet to be discovered and executed at scale?

PS1: Why exactly people pay is a very interesting deep dive on consumer behaviour which we will attack in another edition of this newsletter. The short answer is ‘status’.

PS2: Remember Clubhouse and the noise it generated? Valued at 4bn, raising a few 100mn USD, but struggling to retain users and monetise. And yet, here we have a home grown audio rooms product that has grown and is now monetising at a decent velocity - 285 cr is ~30mn USD.

Given the success of the audio rooms model, a few other companies are latching on to the bandwagon.

EloElo is one. It expands on the ‘live room’ proposition, adding multiple use cases like games, video battles, and calls, on top of the basic proposition. EloElo has just closed a 22mn USD round from investors like Courtside, Griffin, Kalaari, and Waterbridge.

Tamasha.live is another, but exclusively focused on gaming communities. 3mn USD raised in Oct 2021 in a pre-series A round.

Digital Content: Text, Audio Books, Short Video, Regional Video

India 2 audiences are also not hesitating to pay for content. The wave was started by OTT, and has now moved into unexplored and large niches.

Kuku FM, a subscription based audio books platform, generated revenue of Rs 49 cr (5mn USD) in FY 23. The platform provides audio content across personal finance, self help, education and more. The platform has raised 25mn USD from Fundamentum and others in Sep ‘23.

Note: Pocket FM is in the same space and by all accounts has a much larger revenue run rate (some reports say 160mn USD annualised), but it does seem most of this revenue is coming from its newly launched US markets.

Pratilipi is another interesting product aimed at a very specific (and in hindsight, smaller, niche) of text content in regional languages. It posted revenues of 40 cr in FY ‘23. What’s interesting here - 17 cr came from content subscription services which I presume is users buying content on the app, but there is an additional revenue stream of ~7 cr which has come from ‘selling books’. How? Well, it has IP from user generated content, and can now find creative ways to monetise this IP. To this end it has kicked off a partnership with Disney Star which allows them to develop multiple new fiction shows adapted from stories available on Pratilipi. The impact of this on Pratilipi’s revenues is likely yet to show up.

There’s another interesting way to look at these three businesses (Pocket FM, Kuku FM, Pratilipi).

If content IP is a key strength/asset, and these platforms have built distribution to test out content as scale, does it make sense to look at their financials more like entertainment studios and less like tech based subscription businesses?

Studios typically spend a lot on creating and testing content, before it even hits the production stage, and even there studios face a high probability of failure (estimate: only 35-40% of Bollywood movies are able to recover investment). So derisking these large investments in content production by using tested content is significant $ value. The Disney Star partnership with Pratilipi starts making more sense now → use tested content and increase odds of content investments paying off!

Another vertical in content which is being explored for monetisation is short videos for edutainment - by Seekho. Seekho has episodic short video content on topics like passive income, growing on youtube, accessing government services and more. The product works on a freemium model, where you have to pay for access beyond a set number of free videos. (I have some reservations on this model - audiobook content was not easily available and Kuku FM/Pocket FM performed the valuable job of creation + aggregation. Short video on the other hand is easily available, and personalisation is only getting better on large platforms. It remains to be seen whether the content on Seekho is valuable enough for users to pay at some scale. The big advantage these folks have is that they are early, and have raised less venture funding - yes that is an advantage).

I would be remiss if I didn’t mention Stage, whose express aim is to build an OTT for Bharat, starting with Haryanvi and Rajasthani. They have 225k subscribers as of Jan 2023, and adding 25k subscribers every month. Last raised ~5mn USD led by Blume. I have open questions on potential scale, given large costs of content development and the fact that language necessarily limits TAM, and also that every regional media house will launch their own OTT.

Digital Content: Hyperlocal Communities

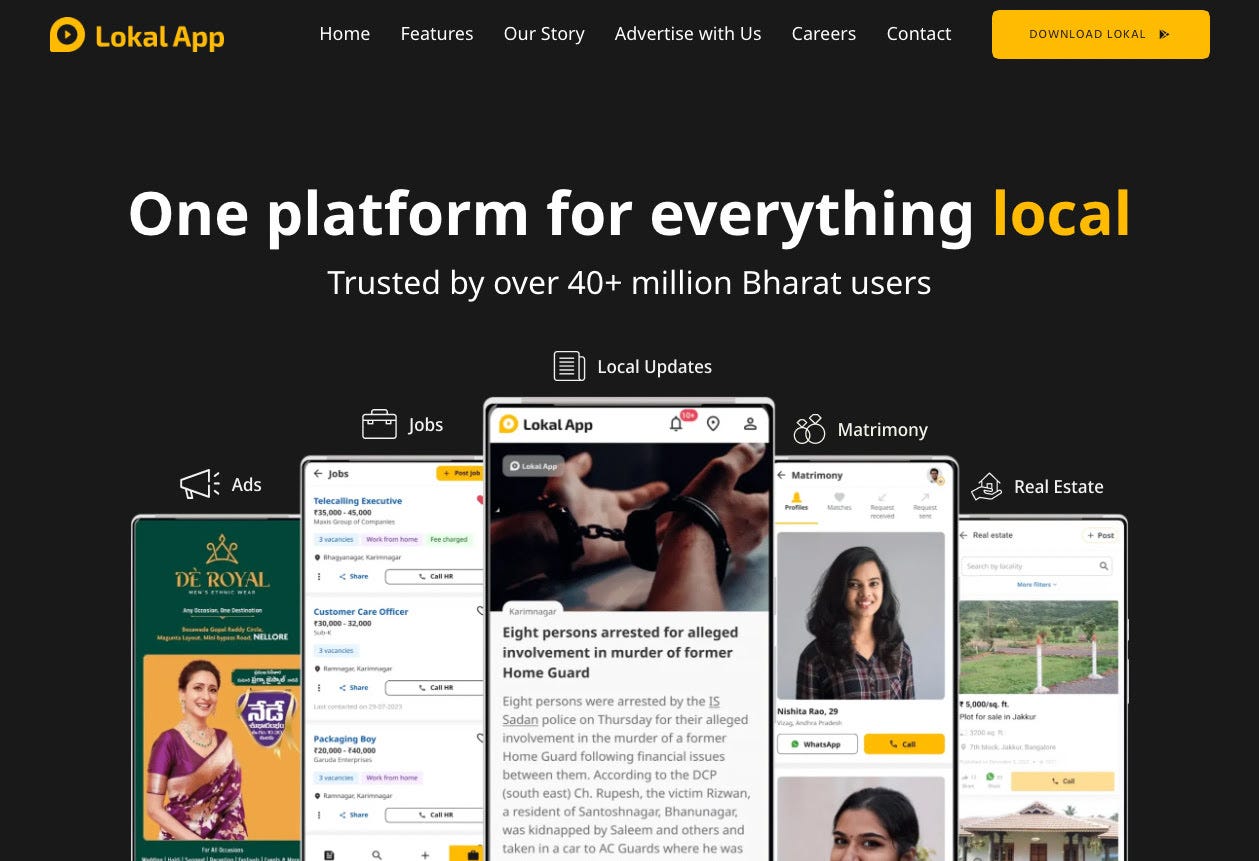

Moving from entertainment to utility - let’s talk about Lokal App. It’s been around since 2018 and has raised 15mn USD in its latest round, and focuses on hyperlocal use cases for a regional language audience. It seems to me that Lokal is trying to go after the revenue sources of regional language newspapers (see local ads, local jobs, matrimony, real estate in the screenshot below). I had previously talked about the language fragmentation of media in India - pick up a regional language newspaper in a non Tier 1 town and you’ll see that the content is very district and town focused (in other words, hyperlocal). Lokal is trying to be this, but in a digital avatar. Presumably this gives them cost advantages (no paper to print and distribute) and targeting advantages (more data for targeted ads), but they have to compete against large established media houses, with their brand, and operational muscle (imagine going up against the manorama group, or dainik bhaskar - these are household names). On top of all this, they have to build a product which works.

(Note: Public App by Inshorts launched as a ‘location based social network’, with news videos as its go to market. It raised ~41mn USD in 2021. Inshorts posted revenues of ~18mn USD in FY ‘22)

Digital Services: Astrology & Devotion

I’ve talked previously about the large market size of religion and devotion, and how there are multiple models of monetisation in the non tech world. The tech ecosystem seems to be catching up now.

Sri Mandir is a pioneer in this space, allowing consumers to set up a virtual temple on their phone, and monetising by allowing them to book pujas online. Check out this deep dive by the good folks over at

It now has competition from Vama (Virtual Astrology and Mandir App). The name gives away a lot, but for redundancy’s sake, it’s an app that offers puja booking and live astrology services (along with consultations from vedic, tarot, and numerology experts). Vama raised 1.5mn USD this month.

In my opinion, the virtual puja (and more broadly devotion) space faces an important consumer behaviour headwind. Devotion is something where users don’t value convenience.

Why? Because any sort of hassle in reaching God is penance, not hassle.

So, beyond a point, how much will users pay for convenience? <shrug>

(Deep dive on devotion coming up in a later edition!)

We can’t end this section without talking about Astrotalk, the breakout success in a space which founders have been trying to crack for some time now. Astrotalk’s revenue grew >2x to Rs 283 cr in FY ‘23, while remaining profitable, with the major source of revenue being sale of online astrology consultation services. That’s impressive to say the least. I attribute their success to sharply figuring out their CAC to LTV loop through the right channel + messaging combination. This means they are able to predict with a high degree of accuracy how much an acquired customer will pay on their app and in what time period. Altogether great execution!

Digital Services: Friendship

Note that I’ve called this ‘friendship’ and not dating. Dating is not something that youngsters in India 2 do, there’s still a little bit of a taboo around the concept. So everything starts with friendship - safe and understandable for both sexes, and more importantly not looked down by society.

An app that has been building in this space for a while is FRND. The app was founded in 2019, and has most recently raised 6.5mn USD in a Series A round led by Krafton (yes the PUBG Krafton). It started out matching male and female users with a product led assisted conversation flow (essentially conversation prompts). But what has really worked for them is assisted matchmaking with a host on an a live audio stream (‘FRND-ship via Matchmaker on audio streaming). The app monetises via virtual gifts sent to the host (‘Private Training Experts’), who coaches users (mostly male users) on how to have a conversation. (Safety and no-sleaze content are now table stakes).

Phew, that was a long list, but only still scratching the surface of potential alternate monetisation models. I’ve avoided drawing conclusions on the business model / potential scale on a lot of these products (that’s for later), but I do want to make a few general notes before we conclude.

Revenue and Valuation are out of whack. I’ve deliberately not talked about bottom lines above. It’s clear to everyone that 2021 was a time of irrational exuberance (All hail ZIRP), and nobody (founders, VCs, employees) escapes the blame for where we are.

But venture is about irrational exuberance? Venture is about backing great teams building in large markets? And if that’s the case, the ecosystem should be geared towards a certain kind of creative destruction, sometimes money needs to be thrown at ambitious ideas. Period. You should for the moon, you aren’t going to get there easily.

Failure is learning: And we should be reasonably ok with the kind of failures that follow. Don’t let past patterns be your only guiding light for future outcomes. Fundamentally, there is still a long way for the Indian economy to go, and that means that there are still large untapped opportunities out there. Trust the process!

Until next time!

Here are a few of the top posts from The Indian Pivot.

If you think this content is valuable please do share with a friend! I have nothing but good karma to offer :)

Nicely written Mithun - I'm more bullish about the micro-transaction & subscription driven ones versus ad driven ones; seeing a lot of the labor folks in our area of NCR use Kuku's paid version (fascinating to hear from them their reasons for why they bought the product)

Insightful. Looking forward to dig deeper on some of them and those beyond those..