Monetising India 2: Lending, Microfinance, and Other Stories

A leisurely stroll through Kerala, financial services, and the role of social mechanics in microfinance

Hello and welcome to another edition of The Indian Pivot!

I’d like to thank Sajith Pai and the folks at Blume Ventures who found the content in this newsletter valuable enough to mention in the latest version of the Indus Valley report (specifically the segmentation of India 2 into India 2.1 and 2.2 which I use to frame my understanding of the Indian consumer). As always, the report is filled with insights on the India opportunity and is mandatory reading for everyone building in the Indian tech ecosystem. Here’s the link. (Page 29 is where The Indian Pivot makes an appearance).

This post is long. Please open in your browser by clicking the heading for a better reading experience.

Also I’m excited to launch The Product Roadmap in cahoots with Vibhav Viswanathan where we speak to product leaders from top Indian companies. First post live now!

Frequent readers of this newsletter would know that I build a lot of my theses on the Indian consumer bottom up, using anecdotes and observations from consumer markets I am familiar with. A lot of times my home state, Kerala, has been the home ground for these observations. I’ve talked about migration, aspiration and premiumisation in the context of food and retail, trends in media and advertising, among other things, within the Kerala context.

Why Kerala though?

Kerala is a good microcosm of how we can expect India 2 to evolve

Here are some indicators about Kerala’s socio-economic status.

Highest Human Development Index (HDI) in India: Because of persistent state investments in education and healthcare, Kerala has the highest Human Development Index in the country. (HDI is a composite index which takes into account education, health and income).

Per capita Net State Domestic Product (NSDP) is 1.5x all India average: Investments in education and healthcare lead to positive externalities, which over time lead to improvements in per capita income. And we see it playing out in Kerala. Net State Domestic Product per capita in Kerala is approximately ~3000 USD in FY ‘22 compared to the national average of ~2000 USD. (Source: Wikipedia, RBI Data).

Economy driven by services & private consumption: If we look at the sectors contributing to Kerala’s GSDP, the service sector contributed 64% in FY ‘22, compared to ~55% for India as a whole. Additionally, latest data suggests that Kerala’s monthly per-capita consumer expenditure rural (MPCE) is 7th in India and 1.5x the all India average (Source: Household Consumption Expenditure Survey 2022-2023).

[Of course, it’s not all fun and games for Kerala. The state has been waging a decades long battle against unemployment, and is currently battling a fiscal crisis. It also has the highest consumption inequality in India measured by the Gini coefficient (2011 data). It is an open secret that a large % of the state’s GDP is driven by remittances.]

The forward looking story for India is also very similar.

India’s GDP is projected to grow at 8%, driven heavily by services and an increase in private consumption, This means that in a few years, key indicators should be closer to Kerala’s current metrics.

Net, net - what happens in Kerala today on the private consumption (i.e. consumer) side is likely to be a good indicator of what would happen in India as a whole, as growth kicks in and we accelerate to a 5 trillion economy.

Side note: There is debate in academic circles on whether India needs to focus more on manufacturing to get a larger % of the population employed, or should we index on services and focus on increasing net income? What are the tradeoffs? Typically countries have gone from agriculture to manufacturing to services, but India seems to have skipped a step, and so the current answer for us seems to be ‘focus on both sectors, with different outcomes’. This is a good summary.

Now back to the newsletter

The thesis so far is that observing trends in Kerala potentially gives a directional sense of where India 2 heads as the Indian economy expands (this is similar to benchmarking India against China to predict what is going to happen).

Today we will draw parallels by talking about a company which recently listed publicly and has built a large business in lending to an India 2.1/2.2 customer.

This company does

small size loans

to women first time borrowers

with a bottom up operating model for lending and collections

The company is interesting because of the niche it targets, the product, the business model, and its scale, all of which sit squarely within the scope of this newsletter - understanding and building for an India 2 audience. Because of its listing, we get an insight into its key metrics and business model through its Draft Red Herring Prospectus (DRHP), which I will quote extensively through the rest of the post. (Assume all quotes/data are from the DRHP, unless otherwise specified).

Which company? And what has it done differently? We’ll get to all that, but first, a quick (or maybe not very quick) sidebar into lending and financial services in India.

Software is Eating the World, but Lending is eating India

India’s financial services sector is massive. According to Osborne Saldanha ‘s excellent and deeply researched newsletterFintech Inside, listed financial services companies in India generate ~500b USD of revenue and ~50bn USD of annual profit. Within this large profit pool, around 60-70% is from net interest income (i.e. lending), and most of it is from secured lending (both B2C and B2B). (Source).

These are eye watering numbers, and gives you some context on why everyone and their uncle is pouring money into fintech as a whole and lending in particular. From 2018 to 2022, Indian fintech funding grew 2.6x to 5.8 billion USD, accounting for 14% of total startup funding. (Source: The Bottomline, Elevation Capital Fintech Report 2023). A big chunk of this funding has gone to startups which eventually aim to make money from retail and SME lending.

It is abundantly clear one of the few large & proven profit pools in India is in lending. New fintechs continue to spawn, trying to attack the consumer lending market from multiple angles. Their go to markets include everything from vanilla lending (Kreditbee) to pay day loans (Fibe), BNPL or buy now pay later (Simpl, LazyPay, Paytm Postpaid), vertical specific credit cards (Scapia), and the new kid on the block, credit on UPI (Kiwi).

This is how a fintech founder friend (5 marks for identifying the figure of speech used here) explained the fintech landscape to me - There is immense demand for consumer credit in India, but the game centres around 2 aspects - distribution and underwriting. Every founder is trying to define a sharp underserved cohort of users, how to acquire them at a reasonable cost, creating specific credit products for them, and deploying an underwriting model to drive the tradeoff between risk and returns. If done well, lending guarantees reasonable scale and profits. And those who are really ambitious can then tack on multiple financial services products on top, and theoretically become the next HDFC. Theoretically.

But like everything else in India, Financial Services is also top heavy

The current narratives on the Indian consumption story are well known. A small % of households drive a majority of the consumption (India 1). According to Goldman Sachs this cohort of ‘affluent Indians’ which earns more than ~10k USD (5x of average Indian per capita income), numbers around 60m today, and is expected to jump to 100m by 2027.

It is likely that lending loan books are disproportionately driven by India 1

Let’s look at two companies which do unsecured consumer lending for India 1 and India 2 to try and triangulate how skewed consumer lending could be.

CRED’s (India 1 consumer) loan origination volume for partners as of May ‘23 (cited by sources in ET, so not sure how reliable) was ~ INR 10,000cr. CRED’s personal loan pre approval is upto 5 lakhs, so taking 2.5lakh as average loan size, that means they had 0.4m borrowers at that point in time.

Kreditbee, which focuses on India 2, disburses smaller ticket size loans of Rs 21k has disbursed loans worth ~INR 14,000cr in FY ‘23. So roughly 6.6m borrowers.

Purely volume wise, CRED’s loan book is close to Kreditbee’s, despite having a 10x smaller consumer base. This top heavy trend plays out at a larger scale in overall financial services, and the numbers below should underscore that point.

Overall financial inclusion in India is still low, and disproportionately affects India 2

Let’s look at some data points.

% of population using UPI: 30%

~300million monthly transactors, 1.4 billion population

Source: Press Information Bureau

% of population with bank accounts: 80%

2011 - 35%

2014 - 53%

2017 - 80%

Source: International Monetary Fund

Note: Active bank accounts (with a deposit or a withdrawal transaction in a year is much less, at about 48.5%)

% of population borrowing: 12%

2017 - 7%

2021 - 12%

Source: International Monetary Fund

% of population with a credit card: ~5%

And here’s a data point from Muthoot Microfins DRHP, under a section titled “Rural sector supporting India growth story”

Rural india accounts for 65% of the population generating 45% of GDP but only 11% of deposits and 9% of Credit.

PS: For fintech nerds, the DRHP has tons of data on region wise and state wise deposit and credit penetration.

Here’s a quick summary of what we’ve talked about so far

Financial services in India is huge, and within it lending is the largest business model, contributing significantly to revenues and profits.

However, financial services and lending is likely concentrated in India 1 on the consumer end. This is expected.

India 2 still has significant under-penetration in financial services, all the way from transactions to credit.

So if we analyse companies which have done unsecured lending well in India 2, then we might understand what works and why.

So let’s dive in.

Muthoot Group: From Gold Loans to Microfinance

What are a few things that come to mind when you think Kerala?

Backwaters

Beaches

Food!

And last but not the least, the jewellery laden bride.

Kerala spends the most on gold in India, nearly 6 times the next highest state.

This has led to a thriving gold loan industry, where consumers take out cash loans by using gold as collateral.

Among these gold loan behemoths is the Muthoot Group. The conglomerate has multiple businesses to its name, but it is most associated with the gold loan business (Muthoot Finance), where it is number 1 by a distance.

It is the largest gold loan provider in India with revenues of INR 11,800 crore and profits of INR ~3,600 cr in FY ‘23. The group has a storied legacy, starting off in in 1939 with a chit fund business and growing into the business it is today.

But what caught my eye was the IPO of a smaller cousin of Muthoot Finance, Muthoot Microfin, which listed publicly in Dec ‘2023. According to its DRHP

We are a microfinance institution providing micro-loans to women customers (primarily for income generation purposes) with a focus on rural regions of India.

In FY ‘23, it posted revenues of INR 1400 cr with INR 160 cr of Profit After Tax.

So it makes money! And that too while operating in India 2, and lending without collateral. How do they do this? What is the secret sauce in their business model?

What is an NBFC MFI?

An NBFC Micro Finance Institution is a category of NBFC created by the RBI which expressly focuses on small ticket loans to borrowers with low household income (upto 1.2 lakhs). More details in the RBI notification here.

Historically the government has supported the microfinance industry, with the objective of financial inclusion, recognising that serving rural India’s credit requirements needs a different kind of beast.

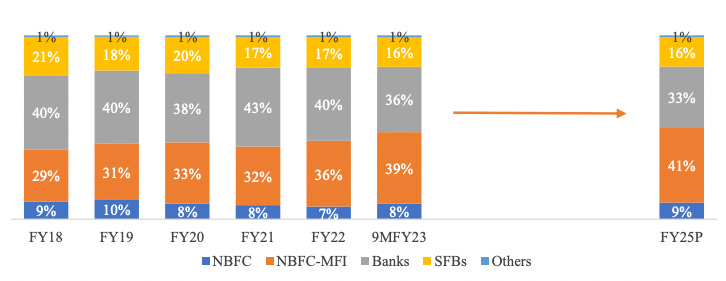

The industry has grown over the last few years, with a CAGR of 21% from 2018-2023. The overall portfolio of loans via NBFC MFIs is expected to reach ₹4.9 trillion (~60billion USD) by the end of the financial year 2025. NBFC-MFIs are expected to gain market share between FY ‘23 to FY ‘25.

This growth is on the back of 2 themes:

Distribution - MFIs have a deep network in rural India, with offline centres and agents present across villages and towns.

Digitisation - Digital payments, increasing bank penetration, digital KYC, and mobile networks have improved operational efficiencies of these organisations from sourcing to underwriting to collections.

Muthoot has spent a significant time building its distribution, and we go deeper into exactly how in the next section.

How Muthoot Microfin Operates - the Joint Liability Model

Very simplistically, a lending business operates on 3 axes - sourcing (or distribution), underwriting, and collections. (Yes, this is super simplistic, and ignores a lot of the actual financial mechanics. But we want to spend time on the consumer side of this business, so bear with me).

Sourcing: How many customers you are able to acquire and how?

Underwriting: How do you evaluate the credit worthiness of someone you want to lend to? What is the rate you will charge her to ensure your risk return tradeoffs are met?

Collections: How will you get your money back?

On the back of good execution on these 3 pillars, Muthoo Microfin has become the fourth largest NBFC MFI in India based on Gross Loan Portfolio. (Dec ‘22)

As of March 31, 2023, our gross loan portfolio amounted to ₹92,082.96 million (₹9200 crores). As of March 31, 2023, we have 2.77 million active customers, who are serviced by 10,227 employees across 1,172 branches in 321 districts in 18 states and union territories in India.

The largest component (~95%) of Muthoot Microfins loan portfolio is group loans for income generation, granted for a maximum amount of Rs 80,000, repayable weekly, fortnightly, or monthly.

Here is the most important part of their operating model - the Joint Liability Group.

Our group loans (including income generating loans and Pragathi loans) are based on a group lending model, catering exclusively to women. An informal JLG (typically comprising between eight to 45 members) provides joint and several guarantees for loans obtained by each member of the JLG.

The JLG model ensures that the groups social dynamics work to ensure that repayments are high and on time. Some of the key aspects of the model are below.

Village Selection: Business development managers conduct surveys to evaluate a village's potential based on population, income, access, and safety before introducing the company and its lending model.

Emphasis on Women: Targets women in low-income households, because women positively influence loan repayment as they are more risk averse, co-operate better in groups, are more accessible, and can meet regularly to handle repayment.

JLG Creation and Member Training: The company’s target audience typically has low levels of literacy and financial awareness. They run a standardised training program to build awareness and improve financial discipline. After this training, a test is administered and members are ‘officially inducted’ into the ‘Joint Liability Group’. These inductions are important events, where the group is given its own identity, members get to know each other, and friendships start to form. The company interacts very closely with group members and even their families to ensure that group dynamics are set up. 'Center Meetings’ are regularly conducted with group members for relationship building, engagement, and for financial transactions (disbursement, collection). These meetings are important for the group to work together and be responsible for individually and overall for loan repayment.

How does the JLG help the company in sourcing, underwriting, and collections?

Sourcing: Think back to how hush-hush conversations were in our parents’ generation when it came to any sort of borrowing. Having to take a loan was considered a ‘low status’ activity, and best avoided or kept secret. So it is important to build trust in an audience which is typically suspicious of lending as an activity and ‘lenders’ as a group.

Muthoot sets up physical centres in accessible commercial spaces which means customers can easily discover them. Offline, for this audience, is a signal of trust. (At least I know where to catch the guy if something goes wrong). Then there are the centre meetings conducted in members’ houses, ensuring that there is visibility to lending and collection activities, which creates an additional marker of trust.

Underwriting: Here’s what I’ve learnt from my interactions with some fintech founders - even though financial data is now becoming ubiquitous (cue digital payments, account aggregator++), lenders who have succeeded in India 2 typically don’t have access to hard financial data (like bank account statements). Even if they do, the data is likely to be sparse. So, over time, they have built their own mechanisms of ‘hard’ and ‘soft’ underwriting (emphasis mine).

Hard underwriting looks at creditworthiness of the borrower using objective data points, but soft underwriting looks at other aspects, and sometimes looks specifically for social signals. For example, how many of the borrowers close family members live in the area? In Kerala villages families typically spread outwards from a central location over decades, and prefer staying close to each other. Entrenched families will not uproot themselves and run away overnight, compared to say a migrant labourer, which makes underwriting someone from a family who has lived for 50 years in the same area easier.

In fact, Muthoot Microfin has built its own credit score mechanism by incorporating these factors.

We have developed a unique credit score card along with Equifax to evaluate the creditworthiness of customers by assigning individual credit scores to our customers. As a result, we are able to risk profile each of our customers individually based on parameters such as payment track record (including any credit defaults in the past two years), demographics, age and location.

Collections: If you’re part of a joint liability group which has a loan outstanding, and the members of the group are those who you know outside of the group (because you have been born, live and work in the same 50km radius), you don’t want to be the bad guy in the group by not paying up on time. In the case of default, you as a borrower could face ostracism not just from the borrowing group, but also from your close friends and family. Now you add the fortnightly group meetings run by the company (often run in group members’ homes), where collections take place, then the probability of collection loss reduces even further.

A combination of all this means that Muthoot Microfin’s Gross NPAs are competitive at 2.97%. We can compare this to its listed peer Credit Access Grameen, which has INR 13,000 crores of assets under management, and Gross NPAs of 1.48%. Or ‘Spandhan Sphoorthy Financial’ with AUMs of INR 6,600 crores, and Gross NPAs of 5.1%. An interview of Kreditbee’s founder suggests that their NPAs are around 3% (as of 3 years ago).

In the traditional banking world, HDFC (using this as best in class) has Gross NPAs of 1.12% in FY ‘23.

By all means, this looks like a good business. (The market disagrees though, and the stock is down ~20% since listing. But there are tons of reasons for that)

Ok. Time for a short break.

Here’s a snapshot of what we have talked about so far.

Financial services in India. Huge.

Lending in India. Huge.

Penetration of financial services and lending in India 2. Low.

Muthoot Microfin. Lends to India 2. Operates based on deep distribution and joint liability groups. Enables it to lend at scale, and make profits.

But…

How is all of this relevant to you?

My assumption is that readers of this newsletter are looking for insights into Indian consumer behaviour, so I’ll try to end with that, and some thoughts on how the model described above could be adapted into a digital product.

What is most interesting is how social mechanics improve all parts of the lending funnel - from sourcing (visibility in central areas + community meetings leading to added trust in the lender and the process) to underwriting (social status is at risk if you default). I’ve previously written on LinkedIn about India 2’s multiplayer mode. Here’s an excerpt.

I've observed that the average Bharat 🇮🇳 user lives life in strongly multiplayer mode. This is deeply rooted in the agricultural and small businesses culture that powers livelihoods in Bharat - you need help to run a non-mechanised farm, and access to credit for your kirana is mostly from your close friends and family. Asking for help is the default mode, ('arre pintu ke chacha ko pata hoga unse baat kar lo'), and in a lot of cases, help is offered up front if it means betterment of the individual, who is expected to pay it forward.

What does this mean for consumer behaviour?

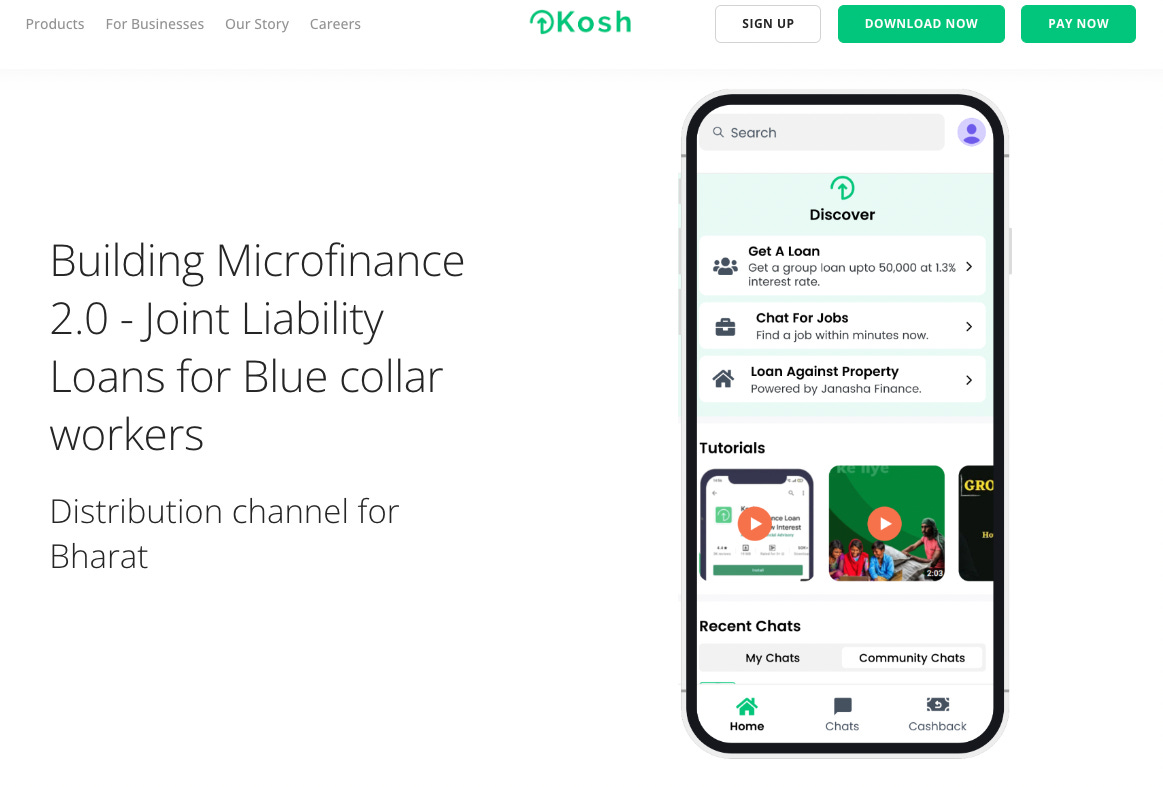

My thesis is that there are large unlocks that can be created if digital fintech products (and maybe all digital products) can replicate the strong multiplayer social mode that is prevalent in the offline behaviour of India 2.

For example, could an app mimic the social mechanics that make chit funds and JLGs (like the above) work? What would such an app look like? What would that mean in terms of cost efficiencies and acquisition scale for a lending businesses? Could group based models utilise referral loops in unique ways to drive down customer acquisition cost (remember that lending business models in India are built around new distribution and/or new underwriting)?

This seems to be what Kosh seems to be doing digitally. A user signs up, invites his friends and applies for a group loan. ~3m USD raised over 3 years.

These are just some initial questions to think about.

Financial services is still early in India, and there is a long way to go. Despite all the noise around the RBI souring on certain business models, the long term outlook on regulation is still positive, and consumer demand is strong. There’s still a lot more juice here, if you look in the right places.

Until next time!

Notes:

Aditya Grover in the comments has mentioned that the RBI is looking closely at MFIs (along with all other unsecured credit), because of their high rates of lending. Something to watch out for.

The more ‘Financially’ oriented readers of this news nerds might be tearing their hair out on this one. I’ve not talked about the business mechanics at all! What about their actual dhandha? Where do they get the cash to lend? What is their cost of funds? How do they manage liquidity risk? And so on. Well yes, I haven’t purely because that’s not the focus of this newsletter. Here the focus is on going consumer insight backward, rather than business model forward.

The important pages about Muthoot’s business model in the DRHP are from page 159 onwards in this link.

If you’re building for this audience in fintech I’d love to chat and exchange notes! Please reach out at mithun [at] theindianpivot.com.

Here’s an interesting chart on how the Muthoot Group thinks about microfinance - its an entry point into their ecosystem where they try to upsell multiple different types of financial products. It’s almost like they are using the microfinance business to build the creditworthiness of new to credit users, and then upselling them larger loans with lower risk. Net positive overall for the group. Fascinating.

How to do upsell? Enter their Super App: “As of March 31, 2023, 1.18 million customers have downloaded the Mahila Mitra application, and 1.70 million customers have transacted digitally with us (through the Mahila Mitra application and other digital payment methods). We are also in the process of developing a Super App along with the Muthoot Pappachan Group, which we plan to use to integrate our Mahila Mitra application with all of the Muthoot Pappachan Group’s products and databases on to a single platform, allowing customers to access all the Group’s loan offerings on a single platform, thereby maximizing our cross-selling opportunities.”

Nothing in this post is to be considered investment advice.

Loved reading the blog, I too have very small holding of Muthoot Micro finance. But let me mention here something I couldn't find in the blog which I believe is the biggest risk in investing in the stock- RBI.

Actually the company gives loans to those female groups mentioned above at interest rates as high as 22-25% because of which their NIMs are very high. Recently RBI has been giving soft commentary around the same, but on 9th Feb, 2024, RBI Deputy Governor came down heavily on MFIs warning that misuse of regulatory freedom would prompt regulatory action.

In such scenario, the day RBI comes up and take action controlling their lending rates, all profitability will be gone in air and stock can tank further. Anyhow, no one knows the future, the stock is cheap though, just wanted to bring this in notice of people reading the blog.

Amazingly written Mithun. I remember some months back I had a chat with someone from one of the leading wholesale lenders in India about what's happening in the MFI space and he said that all MFIs are being pushed to do digital collections but they are averse to it. The low NPAs exist due to 'offline' and 'group' behaviors which would go away in a digital landscape.

Going by this, there is lots of space for 'Fin' in the space but little space for tech. Only businesses willing to invest heavily in Ops would want to get into this business and most digital businesses would likely remain away.