K-culture and the Indian Consumer Story

The Hallyu wave that is sweeping the Indian consumer off her feet

Note: This is a long post, so click the heading in the email to open it in your browser.

—————————————————XX———————————————-———--

As the lights dimmed in a packed theatre in Kolkata, the screen flickered to life with an opening scene - 7 flawless faces came into view. The audience, predominantly young girls, went ballistic, waving light sticks, singing and shrieking along, and generally painting the atmosphere with the kind of exuberance and devil-may-care passion that only teenagers can seem to summon at will. (oh to be sixteen again).

As a casual observer, you’d be forgiven for thinking this might be the premiere of a much awaited Bollywood movie. Or maybe a cricketer was making an appearance to mingle with his fans. Or maybe God himself? (The ABC of India, after all, is Astrology, Bollywood, and Cricket).

It was none of these.

In August 2021, the K-pop band BTS (aka Bangtan Boys), released their first English language single, ‘Dynamite’, 8 years after their first album 2 Cool 4 Skool propelled them into the spotlight in South Korea. Dynamite debuted at number one on the US Billboard Hot 100 chart, earning BTS their first chart topper.

Simultaneously, in India, the BTS ARMY (an acronym for Adorable Representative MC For Youth), got to work on the digital turf. Twitter, Instagram, and to some extent (surprisingly) ShareChat, were abuzz with messages focused on pushing the K-pop groups release to the top of the charts. And the army’s ARMY’s work paid dividends.

“According to data from the music streaming service JioSaavn, there has been a significant shift in the popularity of the South Korean boy band BTS among English music listeners. In January 2020, before the pandemic, BTS was ranked 68th with around 780,000 streams. By October of that year, however, their position had jumped to eighth place, with over 2.3 million streams.” Source: Korea Center

Since then India has been consistently at the top of the charts when it comes to streaming BTS.

“As of January 2023, YouTube videos from the popular K-pop boyband BTS were among the most-viewed K-pop videos on YouTube. Over the past year, Japanese viewers made up the largest share of watchers with around 918 million views on the band’s videos, followed by 778 million views from India and 658 million views from Mexico.” Source: Statista

In February 2023, the group released a concert film in Indian theatres, “BTS: Yet to Come”, which predictably led to chaos (of the good kind). Thanks to the wonders of modern technology (no, not AI), specifically YouTube, you, dear reader, have the opportunity to immerse yourself in said chaos.

Here are a few videos which I encourage you to play, if only to relive what it felt like to be a teenage pop group fan (remember the Backstreet Boys?) with posters of the current musical heartthrob on the physical walls of your room. (Ah, simpler times.)

Here are scenes from a screening in Kolkata.

This is the Chennai ARMY doing their thing.

Kochi is next.

And rounding things off is Hyderabad - warning, this is loud.

—————————————————XX———————————————-———-—

The term ‘pop culture’ came into use around the 1950s, taking a cue from the rise of pop music, and it refers to trends that show qualities mass appeal. Mass media, and more recently, social media have contributed significantly to how pop culture is spread. I’ve spent a good chunk of my career in social media, and as a consequence have spent way more than a ‘healthy’ amount of time on social media apps 😐. But this ‘unhealthy’ time has led me to the realisation that social media in India is where pop culture today is created and transmitted.

There are legends about hedge funds sending analysts to stand outside retail stores to count footfall. The hypothesis was that tracking footfall gives a sense of sales for the store, and can be extrapolated to predict revenues. If you know which way the revenue of a retailer is going before everyone else, you can make money in the public markets by betting on the retailer’s stock.

Something similar can be said of social media today. Pop culture drives a lot of consumer behaviour, and if you’re someone who is building a consumer product, then staying on top of what is ‘trending’ is important.

And what’s trending in pop-culture today?

K-pop, K-dramas, and more broadly, K-culture aka ‘Hallyu’ (the phenomenon of the global rise of South Korean culture since the 1990s).

But wait, wasn’t this newsletter called ‘The Indian Pivot’. Why the detour to South Korea?

Two reasons.

New Opportunities - K-culture is influencing Indian consumer behaviour in many ways - from media to consumer goods. And where there is change in consumer behaviour, there is opportunity.

Impact on India 2 - More importantly, the Hallyu wave seems to be much more diffuse than Western culture, in the sense that India 2 aspirational consumers are also affected. This is unlike the ‘Friends’ first diffusion of Western (American) culture that happened to you and me. (This is evident from the popularity of BTS on JioSaavn, whose consumer base skews towards the middle of the Indian consumer pyramid).

Here’s what we will talk about.

Some reasons for the rise in popularity of Korean culture in India.

Consumer trends that have come out of this - going from music to movies and TV to food, to beauty and personal care, to travel.

—————————————————XX———————————————-———--

The Gangnam style rise of Hallyu

To understand the beginnings of the K-wave, we have to go back a few years. Almost 12 years to be precise.

On July 15, 2012, popular Korean rapper Psy released Gangnam Style. Here’s the YouTube link so you can listen and reminisce (yes, I’m helpful like that).

Gangnam style became an instant worldwide sensation and quickly found its way to India, attracting Bollywood celebrities and the layman alike. From wedding sangeets to college festivals, "Gangnam Style" became a ubiquitous soundtrack, symbolizing the beginnings of the K-wave in India. Psy was the gateway, and consumers started watching more of K-pop - and bands like BTS, BLACKPINK, and EXO started finding their audience. K-dramas took off at around the same time, but there was another orbit shifting macro situation waiting in the wings. And we know what it is don’t we?

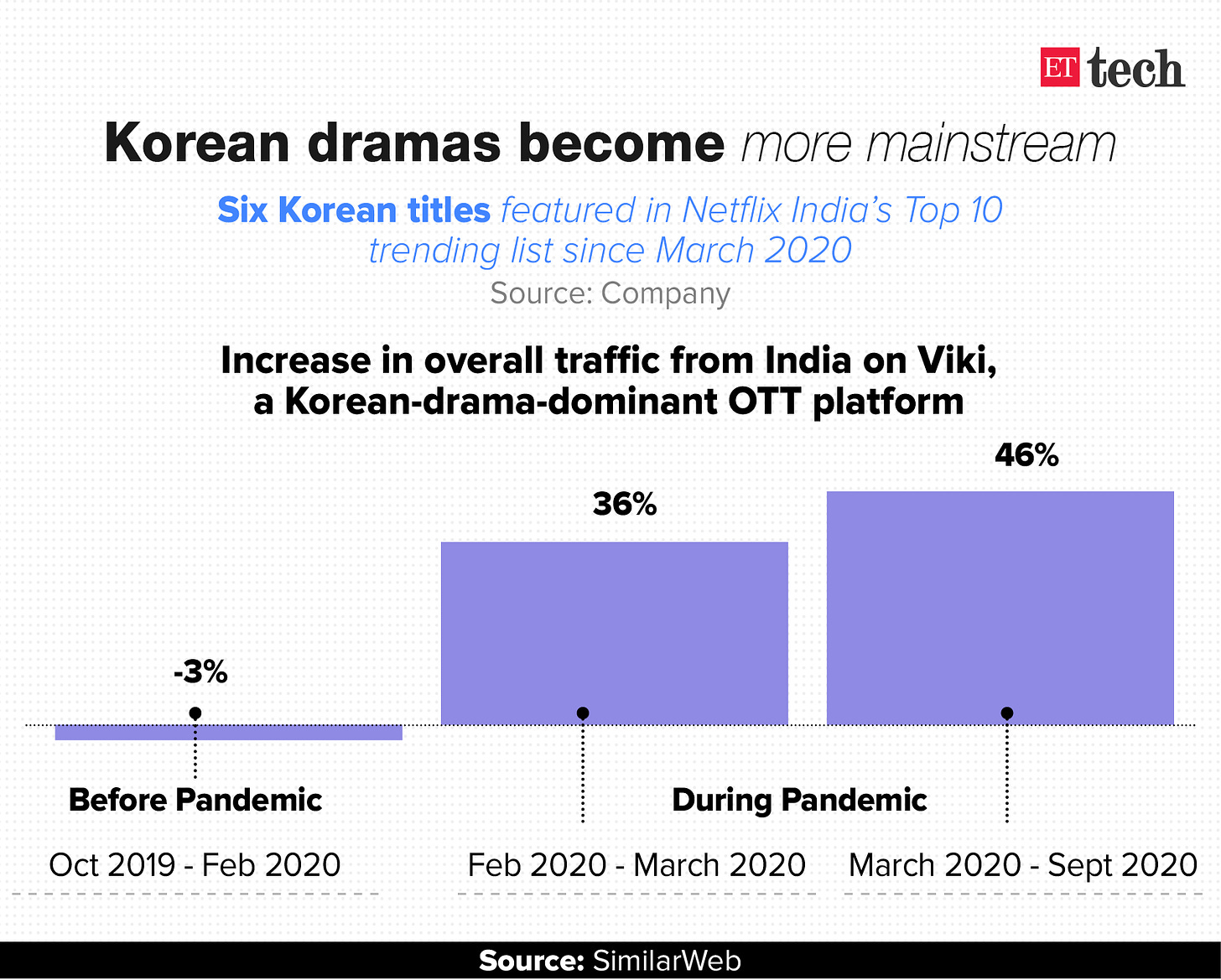

COVID-19 put all of us in our homes, and in turn propelled the K-wave into orbit. Starting with K-pop and BTS, the trend trickled very quickly into increased streams of K-dramas on Netflix and Rakuten Viki (which exclusively streams Asian TV shows).

Euromonitor’s data reveals a remarkable surge in K-drama viewing among Indian audiences, as Netflix saw a staggering 370 per cent increase in K-drama viewership in 2020 compared to the previous year.

Source: Korea Center

But really why? What’s the big deal about Korean TV and music that has gotten people so interested?

—————————————————XX———————————————-———--

What drives India’s love for Korean music and TV?

Note: This is not about top tier Korean media like Oldboy (a movie about a man imprisoned for 15 years, and seeking revenge against his captor), or more recently, the 2020 Academy Award winner, Parasite. These are shockingly good movies, but it’s hard to put them in the league of earth shattering pop culture drivers like Gangnam style.

And to understand how the culture diffused, we start with K-pop icons (once again) BTS.

BTS was ‘incubated’ by the South Korean record label Big Hit Entertainment, and so does not have an organic origin story. They explicitly debuted as an 'idol group' aimed at young audiences. From the very beginning, the focus was on allowing the band members to express their individuality. Their early music focused on relatable themes like school struggles and adolescence.

Why do you keep telling me to go on a different path, hey, take care of your own business

Please don’t force me

(La la la la la) What is your dream, what is your dream, what is it

(La la la la la) It is only this, is it only this, is it

On a same boring day, on every repetitive day,

adults and parents forcefully instill dreams that are molded

No. 1 dream job… a government employee?

And as the band and their audience matured, BTS's music evolved to address more complex issues such as mental health, self-love, and societal pressures.

What fans love is the authenticity of the members - who are encouraged to have their own lives and personalities outside of the K-pop world. This makes them deeply relatable to young India, who are searching for authentic role models, and not someone who is flawless. This is unlike the current Bollywood stars and music icons in India, all of whom seem to derive a lot of their celebrity status from how far away from the masses they are, and can continue to be.

BTS on the other hand, is goofy. Here’s a 10 minute video of them being real.

Of course there is a whole channel about this with ~400k subscribers.

Maybe now you can begin to understand the allure of BTS (and K-pop in general) for teens, and why so many of them filled up theatres for the semi-religious experience of watching their idols with fellow fans.

(This is very similar to the Taylor Swift mania that upturned entire economies in its wake a few months ago, with one key difference - Swifties are likely concentrated in India 1, but BTS has a much more diverse audience base.)

From K-pop to K-drama

“Crash Landing on You” is a popular Korean drama that tells the story of a South Korean heiress who accidentally paraglides into North Korea and meets a North Korean army officer. Over 16 episodes, the heiress predictably falls in love with the officer, who becomes her saviour.

If you replace North Korea with Pakistan, and South Korea with India, what movie does this now remind you of?

Yash Chopra and SRK have a monopoly on this kind of romance, but the similarity of the storylines gives you an insight into why K-dramas are taking India by storm.

“Like Bollywood, K-dramas create an immersive world of their own. The laws of the universe don't always apply here, and plot lines can ricochet between starkly realistic and mind-bogglingly over-the-top. Both are massive industries with millions of viewers and an intense fandom.” Source: BBC

The family shenanigans and exaggerated storylines find relatability with an audience brought up on a steady diet of Bollywood romances and Ekta Kapoor soap operas. So it’s not surprising that the kind of themes that are popular in K-dramas are interesting to Indian audiences.

But the deepest similarities between them are the familial and social hierarchies depicted in these stories. Korean dramas are able to "articulate the death grip that parents have over children that no one in the West will be able to understand the way we do", Ms Nair says.

Plot lines in Korean shows and Bollywood films frequently revolve around the impact this has on protagonists - from choosing who they can love, the careers they can pursue, the obligations women have to their husband's household and the social net provided by families.

Source: BBC

No wonder that K-dramas have been on a tear in India since the pandemic.

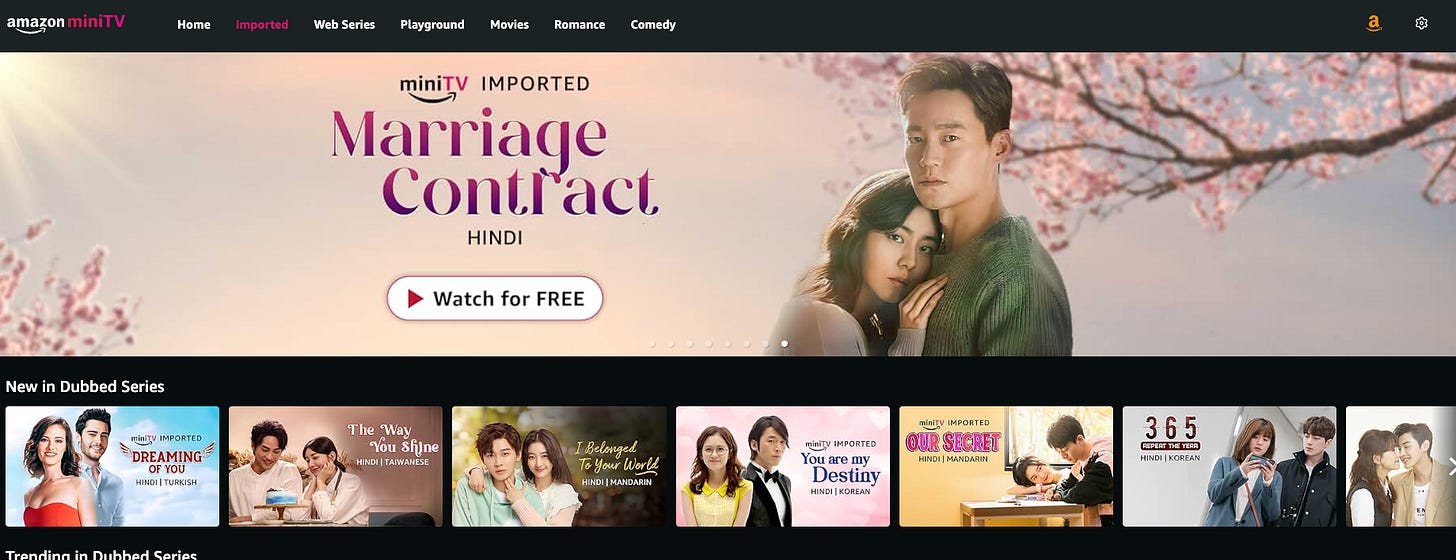

In July 2023, Amazon Mini TV launched section titled ‘Imported’, for International content dubbed in Hindi. It streams top global shows every month ranging from Korean, Turkish, Mandarin and Spanish dramas. A curious observer would go through the shows on Amazon Mini TV and wonder why they resemble the Star TV soaps of old (me, I’m the curious observer).

Hypothesis - Mini TV is Amazon’s content play aimed at engaging an audience that is squarely India 2, and eventually converting them to transactors. This is in line with Amazon’s stated ambitions of expanding beyond their current customer base.

And they know K-dramas sell in India 2, just like Star TV (and its many avatars) do. I wouldn’t be surprised if K-dramas get dubbed into more non Hindi languages.

On his visit to India, the director of the Ahn Hyo Seop and Kim Se Jeong k-drama gave a nod to the Indian version of Netflix hit k-drama Business proposal…. He says that Telugu will likely be the first remake language, followed by Hindi. The proposals are now up for discussion.

Source: Jagran TV

If K-pop and K-dramas, i.e. pop culture media, is so ingrained in Indian consumer habits, what other aspects of K-culture have transitioned to consumer behaviour?

The easy to spot trends are Korean food (what is that spicy noodles that they keep eating?), Korean beauty (HOW ON EARTH DO THE BANGTAN BOYS HAVE THAT GLASSY SKIN!), fashion, and even language.

—————————————————XX———————————————-———--

'Jal-mukkes-seub-nida' - I will Eat Well

This is what families sitting down for a traditional Korean meal say - as a mark of gratitude towards their food.

When pop culture makes its way into your living room (media), your kitchen and dining room is not going to be far behind. There is a strong correlation between the rise of K-drama viewership during the pandemic and the uptake of Korean noodles.

(Yes, I know correlation <> causation, but stay with me).

The viewership of K dramas and K pop on Netflix, an online streaming platform, reported a YoY 370% jump in 2020 and the import of Korean Noodles in India also witnessed a volume growth of 162% in 2020 (according to the Ministry of Commerce).

Source: TOI

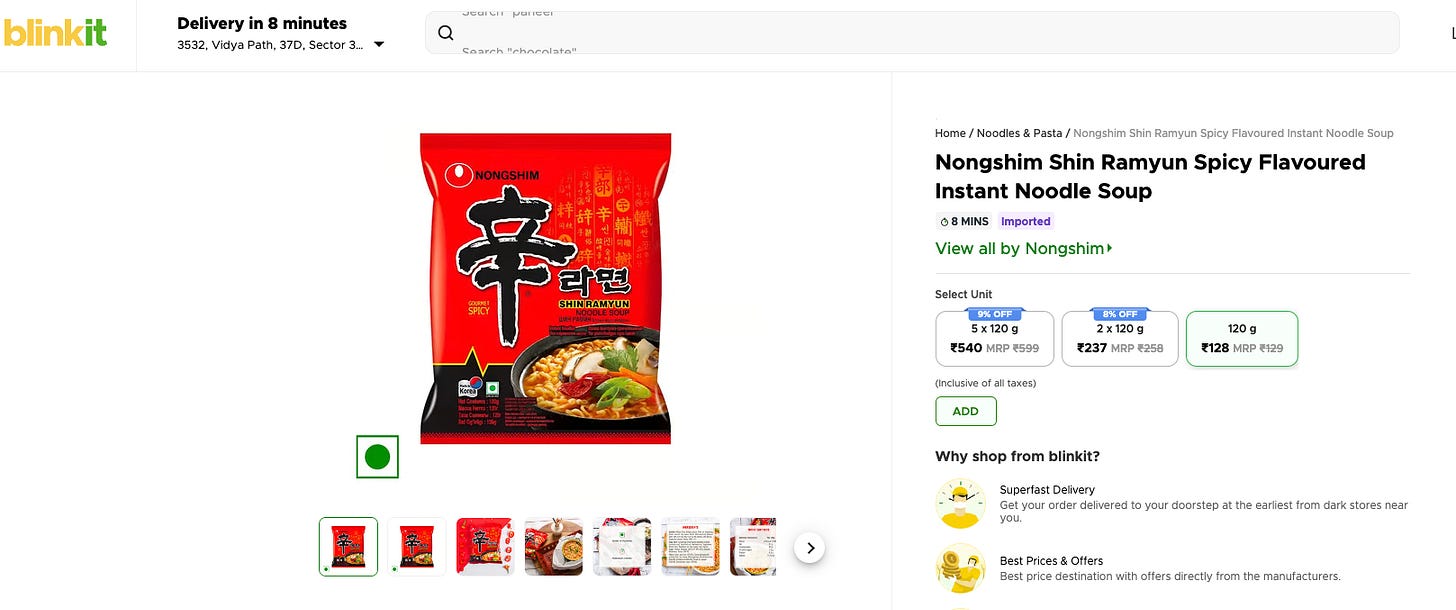

Nielsen IQ estimates that “the size of the Korean noodles market has surged from Rs 2 crore in 2021 to over Rs 65 crore in 2023”. And Korean noodles are now a staple on online delivery platforms - Amazon, Zepto, Instamart, Blinkit et al, with Nongshim and Samyang being the brands of choice.

But what’s so great about Korean food? This one is simple.

Korean food is likeable to the Indian palate because of its ingredients.

(just like K-dramas are palatable to the Indian audience because of it’s themes).

“Both Indian and Korean incorporate many similar ingredients like rice, vegetables, meat, chilli, pepper and spices,” explains Akshay Bhardwaj, head chef at Andaz Hotel, New Delhi. “Also, dishes like kimchi are very similar to flavour-charged Indian pickles which work well for Indian palates that crave heat and spice.”

Source: SCMP

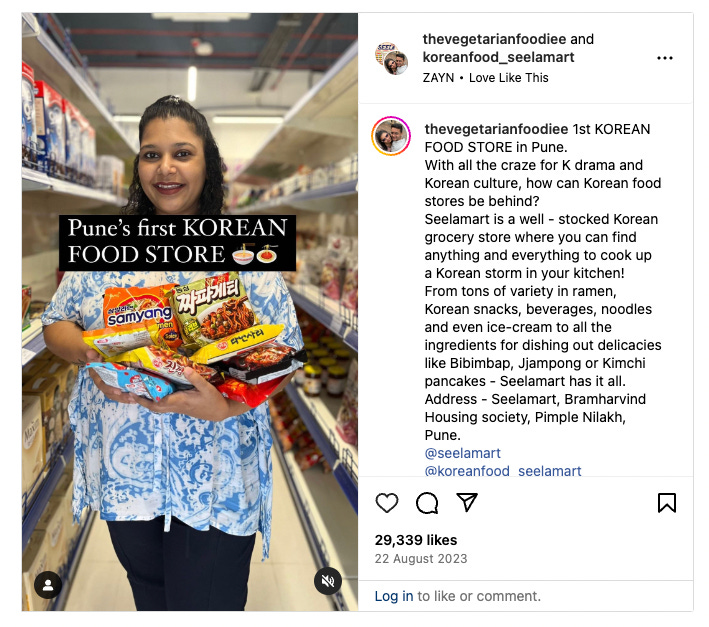

There are specialty stores serving this demand

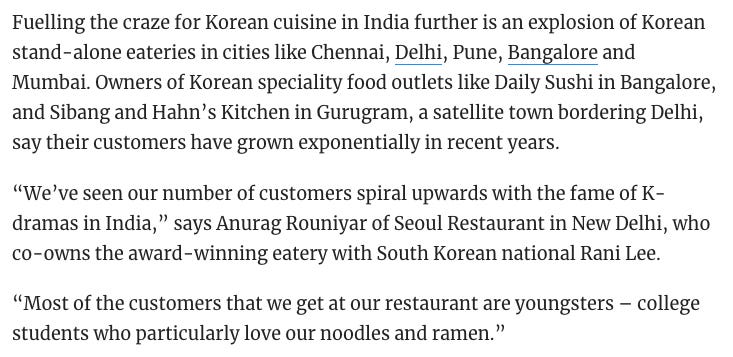

The trend is not restricted to packaged food either

And large FMCG players have caught up to the trend

I repeat myself, but FMCG companies are the pros at understanding consumer trends and satisfying them. So it’s not surprising that Maggi, Nestle, and Knorr have made their presence felt in this market.

November 2023. Nestle India expanded its Maggi brand with the launch of Maggi Korean noodles in two flavours – BBQ chicken and BBQ veg.

Hindustan Unilever - launched the Korean meal pot under it’s Knorr brand.

Nissin – the maker of Top Ramen instant noodles – had launched its Gekki variant of K-noodles.

Capital Follows the Consumer

After FMCG, there are venture backed startups moving into this territory.

South Korean pizza brand GOPIZZA plans to open 50 new outlets across India to add to the existing 50 outlets by the end of 2024. The brand raised $25 million in October 2022 in Series C funding to fulfil its expansion plans in India.

Source: Financial Express

Boba Bhai, a startup which sells Bubble Tea (which is actually Taiwanese in origin, but has a large fan following across South East Asia) has raised Rs 12.5 crore in funding and aims to reach ~100 outlets in the next 12 months.

I’m expecting more to pop on to this consumer trend - maybe packaged Kimchi? Or a Korean KFC which sells the best Bibimbap around?

To round off this section, here’s some good looking K-pop stars reacting to Indian snacks!

And if you, like me, wonder how Korean men have such wonderfully smooth skin, the next section will answer some of your questions.

—————————————————XX———————————————-———-—

—————————————————XX———————————————-———-—

All that is smooth is… glass?

Time for a quick quiz.

How many steps does a skin care routine have?

.

.

If you thought 3 (face wash, moisturiser, and sunscreen) and were patting yourself on the back for being ahead of the times, I’ve got some news for you.

The correct answer is 10.

Yes, that’s what it takes to achieve the smooth glassy skin that K-pop and K-drama stars have, and that brings us to yet another insurgent from K-culture into the Indian home - K-beauty.

Why does the Indian consumer like K-beauty?

In 2016, way before the pandemic, BTS, and K-dramas became mainstream in mainland India, Toinali Chophi set up Beauty Barn in Nagaland. Her company is credited with being “one of the first Korean skincare platforms in the country that made COSRX snail mucin, Holika Holika ceramide cream, and Klairs freshly juiced vitamin drop household names.” She started out with an Instagram page, and had a very clear value proposition - different products for different skin types. She was one of the few to ask the question “What is your skin type?”

This question is an important part of the allure of Korean skin care in India. For a consumer who was told to use Fair and Lovely for all her skin care needs, realising that every person’s skin is different, and moreover that there are products that could solve their unique needs, opened up a new path. Suddenly, consumers have a lot more agency, and a means to satisfy that agency (aptly aided by skinfluencers who flood social media with different types of skin care rituals).

In addition, there are similarities between beauty standards in India and south Korea. For example - the emphasis on smooth and fair skin is taken to an extreme in K-beauty, with the outcome being ‘glass-like’ skin. (Yes, of course this is an unreasonable standard of beauty and no-one should be held to it).

Korean beauty products also use ‘natural’ ingredients like snail mucin, fermented rice water, ginseng, liquorice roots and bamboo. This taps into the demand for natural skin care products in India, currently satisfied mainly by Ayurvedic products. The focus with Korean beauty products is on getting to the root of the problem, and using customised routines to help your skin become healthy for the long term (hence the emphasis on ‘routine’). And why not, if the promised land is skin like this?

Consumers are lapping up Korean skin care

The global K-beauty products market size was valued at $91.99 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 9.3% from 2023 to 2030.1

The skin care market in India is estimated at around 10bn USD of revenue in 2024.2 of which around 0.5bn USD is tagged to Korean skin care.3 The space is getting competitive.

In October 2023 last year, SUGAR Cosmetics’ parent company, Vellvette Lifestyle entered into a joint venture with actor Kareena Kapoor Khan for its skincare brand Quench Botanics. Quench Botanics offers skincare products across key categories like serums, moisturisers, cleansers, sunscreens, etc. formulated in Korean Labs and manufactured in Korea. But, it’s made for the Indian consumer and comes in the price range of `149 up to `999 per product.

Source: Financial Express

Pilgrim, a beauty care startup which has raised 20mn in a Series B round, sources ingredients from South Korea.4 Homegrown beauty e-commerce player Nykaa is not far behind. It claims to have the largest selection of Korean beauty brands available in the market today, and has launched a dedicated K-beauty store. It can see customer demand speeding up, with search queries for ‘glass skin’ and ‘Korean sunscreen’ growing fast.5 Korean brands such as Face Shop and InnisFree are also aggressively increasing their focus on India.

—————————————————XX———————————————-———-—

It’s still early

If you concluded from the approximately 3500 words before this that we are on the verge of an impending epidemic of Korean things, you wouldn’t be very far off the mark. Like all culture shifts, it starts slow, and then all of a sudden you’re eating kimchi at the roadside thela. I kid of course.

We are still in the early bits of this particular cultural shift. And like all things consumer in India, there is a long way to go. For example -

“One of the big challenges in India today for skin care consumers has been that Indian consumers don't actually follow a skin care routine… Our consumers told us that they were very confused by the sheer number of products which were available and did not understand what was the right assortment of products for them to use.” Anchit Nayar of Nykaa. Source

So there’s a large opportunity just in skincare to educate consumers, and show them the benefits of products that are the best for their skin. (Yes, influencers, I’m looking at you).

What’s also interesting about the K-wave is that it targets a young and aspirational class, across both India 1 and India 2. Estimates say there are around ~20mn fans of Korean culture on social media, primed to try things across categories from media to consumer products.

So what will we see next? Student emigration to South Korea? Korean language courses? Cloud kitchens? D2C aggregators for imported Korean products?

Until next time - annyeong!

—————————————————XX———————————————-———-—

![COVID-19: How World Health Organization Names New Infectious Diseases?[Read Guidelines] COVID-19: How World Health Organization Names New Infectious Diseases?[Read Guidelines]](https://substackcdn.com/image/fetch/w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F4d2f96d6-9bde-41a5-a2ce-beffccc4cb44_1500x900.jpeg)

Fascinating read! I can see a K culture influence in cities like Delhi, Pune already. Maybe you could also attribute the explosion in Bubble Tea chains to the K wave?

I have been aware of the spread of K culture but always thought it’s very much an India1 thing. Thank you for enlightening everyone here.