Premiumisation, SuperK and Monetising India 2

How SuperK is enabling entrepreneurs to build for the aspirational Indian consumer, and what that means for kiranas.

Last week SuperK raised 6m USD led by Blume Ventures.

SuperK, which started operating its first store in January 2020, runs about 125 stores in 80 towns across Telangana through a franchise model. The firm focuses on small towns that have a population size of between 20,000 and five lakhs.

Source: Economic Times

What does SuperK do?

From their website

SuperK is the fastest growing supermarket chain in Andhra Pradesh, driven by its mission to bring modern retail experiences to the tier 3 and beyond towns of India. Started by experienced entrepreneurs from BITS Pilani, SuperK is empowering entrepreneurs from small towns to easily own and operate supermarkets using its data-driven, tech-enabled systems and inventory-light business model, along with the benefits of procurement, intelligence, branding and marketing at scale.

SuperK a supermarket in a box (picking up from

‘s characterisiation in his newsletter Digital Native). If you have the capital and the mindset to start a business then SuperK helps you across all the steps - from store setup to procurement, operations, financial management, and demand generation. The entrepreneur (franchise owner) runs the supermarket, and SuperK owns the consumer facing brand (and that’s why they call themselves a ‘supermarket chain’).I think this is a fantastic idea - and when I read about it, I realised it hits on a lot of themes I talk about in this newsletter vis a vis the India 2 consumer and how to monetise.

(Aside: I'm also a little peeved with myself for not noticing the company earlier.)

So here's a short analysis on why I think SuperK is a great representation of the kind of trends that drive India 2 today:

The Aspirational Indian Consumer

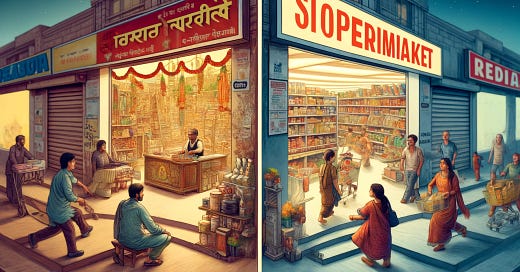

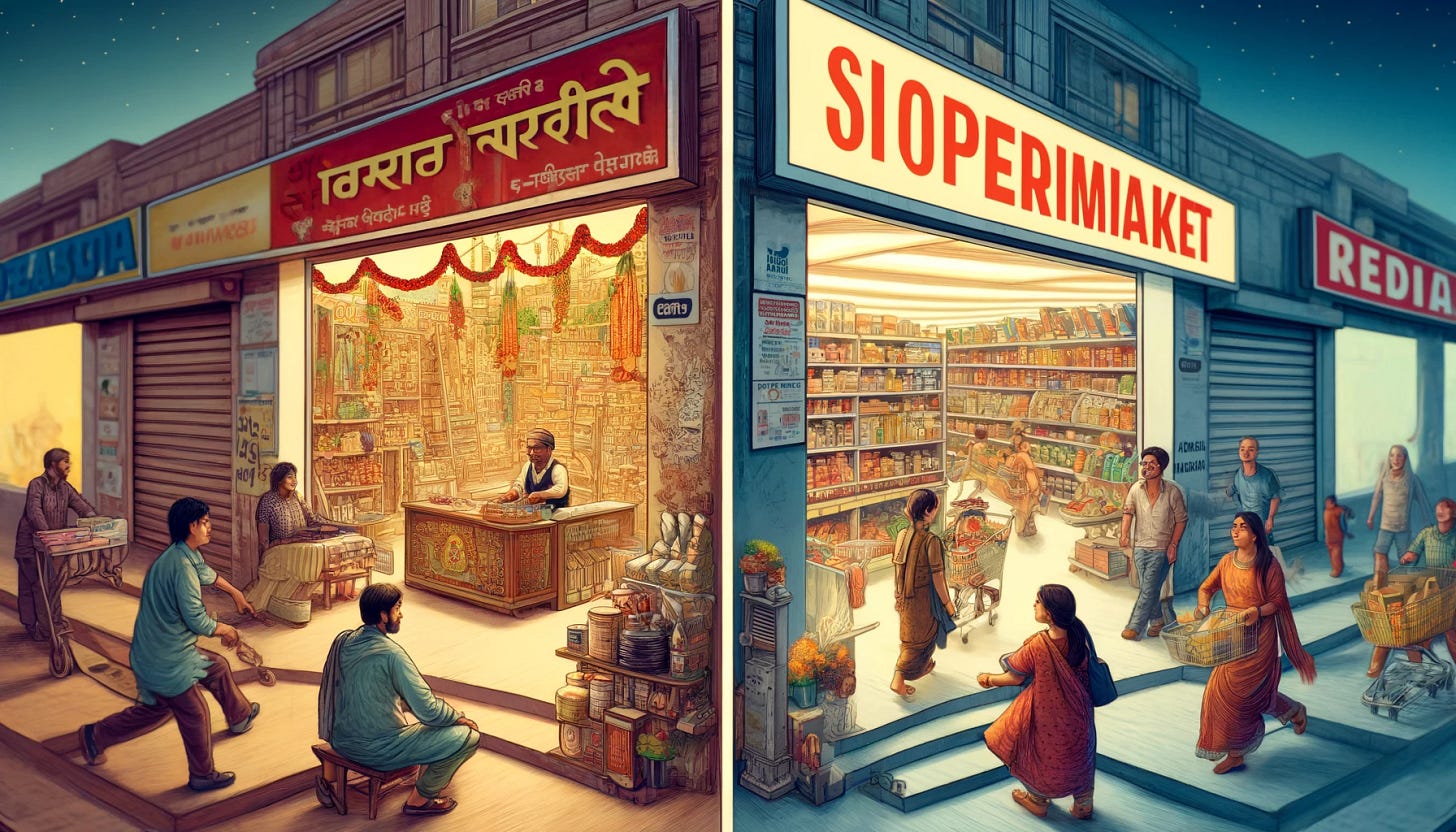

Premiumisation - Consumers don’t want a better kirana

Note: I am deliberately not talking about the economics of the current business, because as always the focus of this newsletter is to focus on the consumer and what she wants. The underlying assumption I always make is that the best entrepreneurs will figure out how to make the business model work.

The Aspirational Indian Consumer

At the risk of sounding like a broken record, I will repeat a bit of what I have said in previous editions of The Indian Pivot.

The India 2.1 consumer is middle income, thinks in a regional language, and has money to spend (the amount of this spend is not very obvious/visible in aggregate national statistics like GDP).

And with the internet and social media in their pockets, previously conservative Indians are seeing what a better life looks like (fancy phones! airpods! colourful sneakers! KFC!).

She is also realising that these products are within their reach, for a price (e-commerce delivers to almost all the ~20k pincodes in India).

As a result of all this, tightly held purse strings are now being loosened on consumption. (Private consumption continues to sustain the Indian economy and it has been steadily rising over the last decade - Source).

Net-net: The India 2.1 consumer is aspirational and has money which he is now willing to spend on things which make him feel good.

Aside: Data also says that a lot of this consumption is being fuelled by debt, because incomes are not rising in tune with aspiration, but that’s a thread we will explore in a different post.

Premiumisation: From Kiranas to Supermarkets

More than 70% of the new products launched by India’s largest consumer goods maker Hindustan Unilever in last two years were in the premium segment.

This is just one of the many data points that tell us that businesses are focusing on catering to the increasing aspirations of the Indian consumer. The article above has lots more examples and data points.

In food - I’ve also talked about the local versions of Western fast food (pizzas, fried chicken) popping up in Tier 2 and Tier 3 towns. They provide a premium experience (clean shops, good seating, lighting, air conditioning) at an affordable price point.

Another trend is the increasing investment in malls in Tier 2 and 3 towns, and more generally, in modern retail.

The story of Dukaan Tech

We’ve all heard the story of the Indian kirana over the last few years: Mom and pop stores know their customers intimately, provide convenience of delivery, and can give credit using soft underwriting (read this part of my previous post). This is why they will be able to give stiff competition to e-commerce and other organised retail.

Building on this narrative, a lot of startups aimed to help kirana stores do their job better. The space was collectively known in VC speak as ‘Dukaan Tech’. None of them, however, have been breakout successes. I put that down to two reasons.

1/ Consumers don’t want a better kirana

The first reason is that the consumer herself is not enamoured by the kirana experience anymore.

Today her increasing aspiration means that she is looking for more than just low prices in her everyday buying experience. The modern retail shop is how every customer wants to see themselves shopping - browsing aisles full of never seen before products, in a well lit and air conditioned space, with a trolley that they can roll along with her kid sitting in it. Shopping is an experience now, and she can actually make a family outing of a supermarket trip!

Dukaan Tech startups assumed that kiranas would survive and thrive, and built products to help run kiranas better.

Shop Kirana - Kiranas order products from FMCG brands

Khatabook - Remind your customers to pay up

Paytm PoS device / Sound Box - Payments and settlement

Dukaan - Enable kiranas to set up a digital storefront.

None of these startups accounted for the fact that consumers didn’t want better kiranas. They wanted a fundamentally different shopping experience like the fancy well lit supermarkets and premium modern retail.

And business owners will need to keep up.

2/ Point solutions are not adding up to something greater than ‘sum of parts’

Running a business is tough, especially running something like a supermarket, where margins are tight, and the amount of money you make depends a lot on operational efficiency. A lot of kirana shop owners simply don’t have this muscle. Selling point solutions for different parts of the ‘kirana operations’ value chain is not really adding up to a significantly different experience for the business owner.

Even though these solutions might solve individual pain points (like ordering goods, or payments, or credit), a combination of all these solutions in one place will have more value than a simplistic sum of the parts. This is even more important if you think about the skill and knowledge gap that exists for an average shop owner - a managed services model that guides them through the different parts of the process will work better.

Enter SuperK - Supermarket in a Box

The trends above combine to create somewhat of a perfect storm for SuperK.

Consumers want a step change in their shopping experience (and not just a better kirana) → SuperK helps entrepreneurs set up supermarkets → And provides advice and support on each step of the process, increasing the entrepreneurs chances of success.

SuperK works with the entrepreneur across all the steps in setting up a store and the output is a standardised supermarket, run under the SuperK brand name.

(The video from which the screenshots below are taken is titled How to Start a Supermarket, and this will remind startup nerds of Sam Altman’s famous How to Start a Startup lecture for YC).

For example, in the Store Setup phase, SuperK identifies where to set up the store, what kind of furniture should be bought, what the ambience of the store should look like, and even what kind of shelves the store should use. All of these matter to juice the already thin margins of a retail store. But so far, how to approach each of these steps would be known only to top tier retail practitioners in large supermarket chains. SuperK democratises access to these important playbooks.

More screenshots on how SuperK helps in different parts of the value chain

How SuperK adds value in Financial Management

How SuperK adds value in Procurement

Wrapping Up: What other businesses can be put inside a box?

One way to think about SuperK is a roll up for physical stores? What Mensa does for Amazon first brands, SuperK does for physical stores.

Today anyone can be an internet entrepreneur. You can sell anything on the internet, and there are a bunch of businesses which enable that for you. For example, if you are a creator on Instagram, you have Wishlink to set up your storefront, OneImpression to find gigs from brands, Capcut to help you edit your videos, and Gumroad to sell courses on how you have done all of this well to upcoming content creators.

SuperK is an analogue of this process in the physical world - enabling entrepreneurs with tools to sell physical products.

What other business models can we use this analogy for?

Digital Marketing in a Box: I’ve spoken previously about the struggle that small businesses in India 2 face with digital marketing. All small business owners know that setting up their pages on Google Maps, Instagram and Facebook is how they will drive traffic, but they are woefully ill equipped to do this. Could there be a business in a box for someone who wants to become a digital marketer for hyperlocal SMBs?

Services in a Box: Similar to supermarkets, there are opportunities for premiumisation in services - beauty salons and fast food come to mind. What would a business which helps entrepreneurs run branded fast food chains look like? Would they plug into the digital marketers to generate demand via food influencers, plug into Swiggy to generate order revenue, and use Zomato’s hyper pure to order fresh produce.

There’s much more to do here - and the path has been forged by SuperK. Congratulations and more power to them!

That’s all for today folks! As always, please reach me at mithun [at] theindianpivot.com if you want to chat. I spend my time between writing content, consulting early and growth stage companies, and working on some ideas of my own - so happy to jam!

Also please share this post if you find it valuable!

Wow! Customer don't want better kiranas but a better Shopping experience! Really insightful

With the rise of Quick Commerce in tier 1 cities, tier 3 and below cities are perfect for such startups. As these QC will not come to these areas. However, Tier 2 cities will be tricky, where both these Franchise models and Quick Commerce both will try to get a share. Blinkit is also experimenting franchise model for its dark stores across 27 cities.